Agentic AI: Auditing Beyond Automation

Agentic AI: Auditing Beyond Automation

The integration of Agentic Artificial Intelligence (AI) in financial auditing represents a paradigm shift from traditional sampling-based methodologies to comprehensive, autonomous analytical frameworks. This white paper examines how Agentic AI systems enhance audit quality, efficiency, and coverage while preserving the irreplaceable elements of professional judgment and ethical oversight that define the auditing profession. Through analysis of current implementations and emerging trends, we demonstrate that AI serves as a powerful augmentation tool rather than a replacement for human auditors.

There's been a lot of buzz lately "AI will replace auditors," "robots are taking over," "Alexa is learning IFRS." Let's clear the air: Agentic AI isn't here to steal jobs. It's here to help you finish your audit before the coffee goes cold, hit your budget, and maybe even clock out early once in a while (gasp!).

KPMG's 2024 survey reveals that 99% of businesses will adopt AI by 2027, indicating an inevitable transformation in the auditing landscape. However, this transformation enhances rather than eliminates the role of professional auditors (Schreyer et al., 2024).

Auditing is evolving and fast. But the fundamentals haven't changed: delivering high-quality work, upholding professional standards, and managing risk. The difference? Now, you have an intelligent assistant who can handle the heavy lifting.

This paper explores how AI transforms routine audit tasks while preserving the irreplaceable human elements of professional judgment, client relationships, and strategic insight.

Think of Agentic AI as your ultra-efficient audit sidekick like a hyper-focused intern who never sleeps, never complains, and actually enjoys sorting through 10,000 line items of inventory valuation.

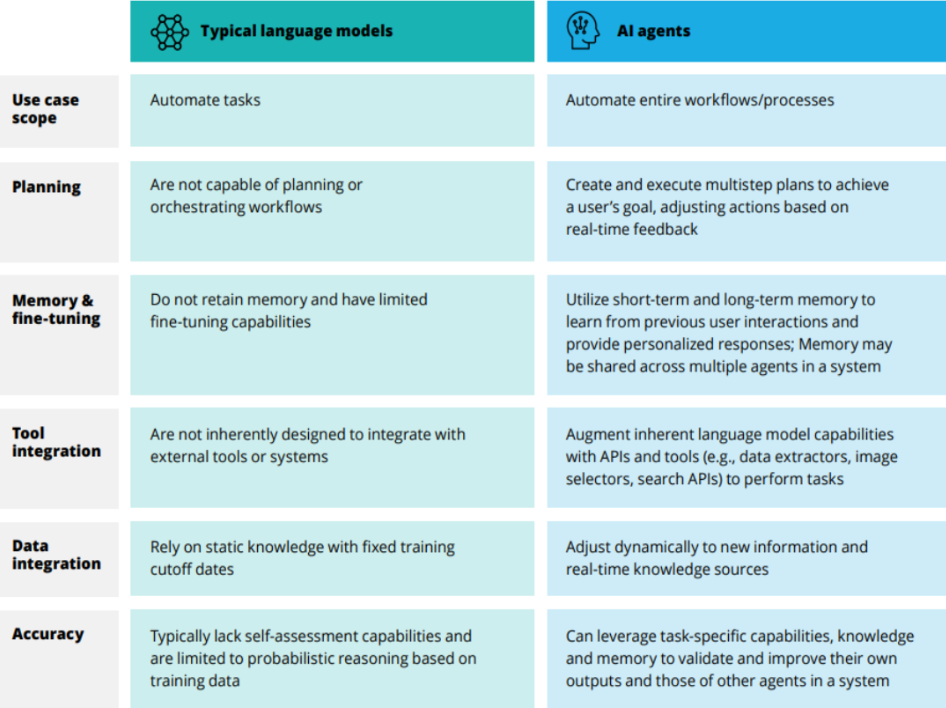

Agentic AI systems leverage large language models (LLMs) to create autonomous systems that can enhance auditing by managing complex and interdependent tasks (Schreyer et al., 2024). Unlike traditional automation, these systems adapt their approach based on changing circumstances, learning from engagement patterns and continuously monitoring for emerging risks.

The breakthrough of generative artificial intelligence is the ability of technology to understand and respond to natural language, leading to the rise of sophisticated AI agents (Wolters Kluwer, 2025). This means AI that can independently execute complex testing procedures, adjust strategies based on risk assessment, and provide real-time insights throughout the audit process.

This isn't about replacing judgment, client communication, or professional skepticism. It's about giving you a superpower; automation that makes your life easier, not shorter. AI is a powerful tool designed to augment and enhance the work of auditors, enabling you to focus on areas that truly require human insight, relationships, and reasoning.

Source: White paper on “Prompting for action How AI agents are reshaping the future of work by Deloitte AI Institute. (2024)

Auditing is far more than a mechanical, rules-based task. At its core, it requires a deep understanding of business contexts, the ability to exercise skepticism, and sound professional judgment. Auditors are tasked with assessing the accuracy of financial statements, evaluating internal controls, ensuring regulatory compliance, and uncovering potential fraud. These are high-stakes responsibilities that demand real-world experience, professional integrity, and emotional intelligence qualities that AI simply doesn't possess.

The Institute of Internal Auditors (2024) emphasizes that while AI can process vast amounts of data, the interpretation of results and the application of professional skepticism remain fundamentally human capabilities. This won't eliminate auditors, but it will redefine their roles (Cambridge Judge Business School, 2025).

A key component of auditing is professional skepticism, the mindset that questions, probes, and looks beyond the obvious. While AI can scan data for anomalies at lightning speed, it lacks the intuition to read between the lines, understand motivation, or sense discomfort in an interview. Auditors don't just follow the evidence, they interrogate it.

This human aspect becomes even more critical when communicating with clients. Audits involve trust, diplomacy, and the ability to ask tough questions tactfully. AI can surface insights, but it can't interpret body language, adjust to interpersonal dynamics, or navigate sensitive conversations.

Ethical judgment is another crucial factor. Auditors operate in gray areas where the right choice isn't always the obvious one. While AI can be programmed with rules, it can't internalize values or moral frameworks. Agentic AI systems must be designed with transparent mechanisms for auditability, ensuring that financial professionals can interrogate AI-generated outputs and override decisions where necessary (Moody's, 2024).

Let's be clear: AI is not here to replace auditors. But auditors using AI will replace those who don't. The Big Four accounting firm Deloitte, PwC, EY, and KPMG are at the forefront of this transformation, leveraging AI-powered tools, cloud-based platforms, and advanced analytics to improve efficiency, accuracy, and transparency in their audits (Big4 Stats, 2025).

For those in accounting and finance management, agentic AI will likely be phased into existing software, and users may notice more user-friendly interfaces that can produce more sophisticated results (Journal of Accountancy, 2025).

So how exactly does it help?

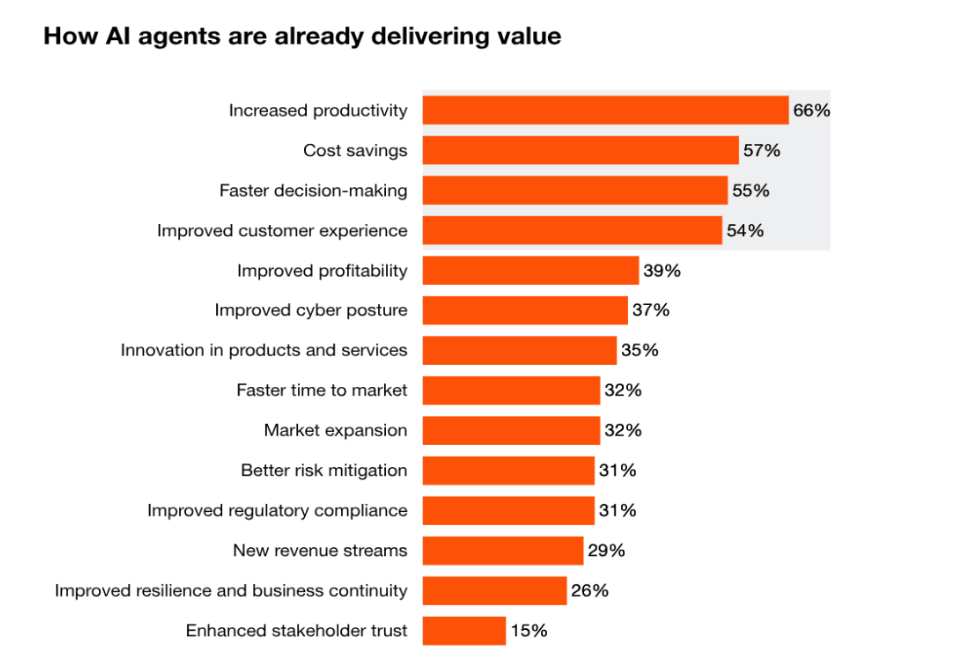

Source: PwC’s AI Agent Survey, May 2025, base: 245

Despite its strengths, AI can't replicate the unique human skills that define quality auditing. It can follow rules, but it can't weigh context or handle surprises. It can suggest but not decide.

The American Institute of CPAs (2024) emphasizes that professional skepticism, ethical judgment, and client relationship management remain exclusively human domains. Auditors navigate shifting regulations, unexpected findings, and gray zones with a blend of experience, adaptability, and ethical awareness. These are capabilities no algorithm can match. The real value lies in the synergy AI handles the data, while humans bring insight and perspective.

| Traditional Audit | AI-Enhanced Audit |

|---|---|

| Sample-based testing | Full population analysis |

| Manual data entry and reconciliation | Automated data processing |

| Reactive issue identification | Proactive risk monitoring |

| Standardized procedures | Adaptive, risk-based approaches |

| Time-intensive documentation | Automated, intelligent reporting |

| Limited fraud detection | Advanced pattern recognition |

| Resource-constrained analysis | Comprehensive data analysis |

| Sequential task execution | Parallel processing capabilities |

The trajectory of AI adoption in auditing is clear. Research by Vasarhelyi and Kogan (2017) projects that by 2030, continuous auditing powered by AI will become the standard practice across major accounting firms. However, this evolution will enhance rather than replace the fundamental role of professional auditors.

Agentic AI isn't here to take your job, it's here to transform it. For firms ready to embrace change, it offers:

© 2025. All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the author.